Arthur Smith makes an interesting argument.

I don’t understand what a global overall “borrowing from the future” could mean in any physical sense. Maybe you have something specific in mind?

With monetary debt every loan has two sides: the borrower and the lender. There is a promise that the borrower will pay back the loan – with interest, so that’s a promise of future exchange, a commitment by the borrower to redirect some of his future income to the lender. But there is no physical constraint involved: it is merely a contractual obligation between borrower and lender, and can be broken under various conditions without any fundamental damage to the world.

Clearly every time a dollar is borrowed, a dollar is owed. The transaction of borrowing money does not create or destroy total wealth in itself; one party owes a dollar, another is owed a dollar, so in the aggregate nothing happens.

After acknowledging that this is absolutely algorithmically true, I note that it is not what my conventional Keynesian macroeconomic prof taught me in Econ A01 at Northwestern in 1973 or so. (Wish I could remember his name, Robert something I think, he was an adviser to McGovern’s campaign shortly thereafter.) He did not teach Keynesianism as a theory. He taught it as established fact. We would never ever have another depression because Keynes.

According to professor Bob, “public debt is OK, because we are borrowing from our future selves“.

So did we borrow from our future selves (thus committing to growth) or did we borrow from the Chinese (thus giving them an asset to balance our deficit).

Well, the crucial thing to understand is that the bank and the government can lend money that they don’t actually have. This has always been the secret of banking, and why, ordinarily, having a bank is the best possible business, with the possible exception of evangelism. In fact, when you put money on deposit at the bank, the bank gets permission to lend out some multiple, larger than 1, of that money as loans. This quantity is controlled by government fiat in some way.

I believe something very much like this is true in every non-Islamic country, by the way, except maybe the very weirdest pseudosocialist autocracies like Myanmar and North Korea. It includes contemporary Russia and China, though perhaps not their communist predecessors a generation ago.

So the point is, something did happen in the aggregate. The total of assets and liabilities remains zero, of course, by the fundamental theorem of accounting ledgers. But the absolute quantities of liabilities increased.

Now, why is the bank lending you money? After all, a bird in the hand is worth two in the bush, right? Well, because you agree to pay back the loan, plus inflation, plus coverage for the bank’s risk, plus a profit for the bank. As we all experience with mortgages, in the end this is a significant penalty. It does not show as part of your or the bank’s credits or debits (if you win the lottery tomorrow, you can settle your mortgage account with the bank next week, after all) but is something you implicitly owe the bank in addition to the amount you borrowed.

This is the engine of capitalism and it runs on optimism. The bank has some confidence that you (or your insurance company) will repay, or find someone else who can repay to buy the house from you, or in the worst case, that it can resell the house after repossessing it. In any case, the likelihood of losing most of the value of the house (or business) is small enough that it can be placed in a statistical category on which a profit can be made.

When you take out a mortgage, you are borrowing from the bank. But you are also committing your household to a specific level of economic function, such that you expect to be able to pay off the house and all the financial overhead associated with the loan. So although you are borrowing from the bank, you are also borrowing from yourself. You are saying, in order to have the pleasure of living in a house before I have paid for it, I promise to work hard enough to have enough surplus to pay for the house and the financial overhead.

You are borrowing from your own future earnings. If you expected to lose your income, you would not take out such a loan. If the bank expected that, they would not give it to you. At least, that was the idea until recently, but let’s leave aside how the pattern failed.

The point is that when China buys US bonds, China is assuming that the US will pay them off.

If Tea Partiers come in and break the US economic system because they are too stupid to learn how the system works before taking hold of it…

Well, it could break in a number of ways that my Keynesian prof would have found absurdly unlikely, let’s just leave it at that.

But in the aggregate, every loan that isn’t disguised charity is an optimistic bet on the future of the debtor. And pretty much all the money comes into its strange ghostlike existence through such loans. So every dollar in circulation represents most of a dollar bet on the future. It’s a “promissory note” that no longer promises gold or silver. It simply represents somebody’s promises to gladly pay the bank on Tuesday for a hamburger today.

And as for Treasury bills, they are a special debt that is explicitly incurred by the nation as a whole, so its implicit problem is for the future prosperity of the nation. Without growth, the debt payments gradually become insurmountable. Without growth, that is, borrowing from your future self is destructive.

And that is why I think Krugman is not entirely right. We can’t necessarily take up as much public debt as is needed to go back to “full employment”, never mind expect the private sector to pick up the slack when “demand” goes back to baseline.

At this point future growth is not a sure thing. At some point, it becomes a sure not-thing. And whatever that point is, it’s not clear we should be carrying debt at that time.

Fortunately there is an immense amount of wealth in the US and the wealthy are hugely undertaxed, so if anybody were making any sense there would be no reason to take on any debt.

But eventually, debt does matter.

What happens when the optimism is misplaced? Well, we are seeing exactly that now. The sudden disappearance of “wealth” and widespread increases in various stresses and demands, even though little or no physical damage was incurred!

This is bad for the debtor and bad for the creditor. It is no zero-sum move for the creditor to write off the loan and the debtor to lose access to credit. And this bad thing happens when growth is less than foreseen. And a worse thing happens when zero growth is foreseen.

Nothing.

Nothing happens. Zero growth, basically zero credit. And since we have arranged things so that we can only feed ourselves when something happens economically, well, everything goes to hell in a hurry.

So we’ll have to change that. But the holders of debt will not like any prospect of growth stopping. Not one bit.

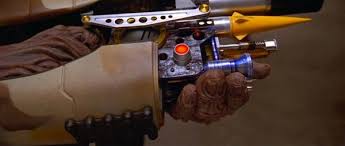

Zorg: I hate warriors, too narrow-minded. I’ll tell you what I do like though: a killer, a dyed-in-the-wool killer. Cold blooded, clean, methodical and thorough. Now a real killer, when he picked up the ZF-1, would’ve immediately asked about the little red button on the bottom of the gun.